income tax calculator uk

By using Sprintax you will also get the maximum US tax refund. Your taxable income is the amount you earn above the personal allowance 12570 for 2021-22 and 2022-23 and any other reliefs you are eligible for.

Listentotaxman Uk Paye Salary Tax Calculator 2022 2023

Tax help for older people.

. Estimate how much tax credit including Working Tax Credit and Child Tax Credit you could get every 4 weeks during this tax year 6 April 2021 to 5 April 2022. Salary Calculator Our salary calculator calculates your income tax and national insurance contributions. This is your personal tax-free allowance.

Its fully guided more cost-effective for you and will guarantee you stay fully compliant with US tax laws. This service covers the current tax year 6 April 2022 to 5 April 2023. Income tax bands rose on 6 April 2018.

4 or in a numeric format eg. For example if you fall into the 25 tax bracket a 1000 deduction saves you 250. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to 750000.

Note When entering pension in a numeric format please use the same frequency as you used to enter your gross salary. Age UK 7th Floor One America Square 17 Crosswall London EC3N 2LB. Help us improve GOVUK.

Check your tax code and Personal Allowance. The late filing fee is. So by the time you.

Deductions lower your taxable income by the percentage of your highest federal income tax bracket. Income tax is paid on money you earn that could be from being in employment being self-employed receiving a pension and other forms of income such as from letting a property. You can now use Sprintax for your US tax return.

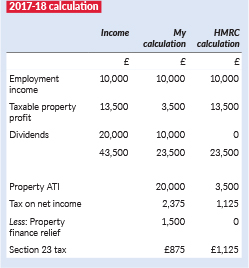

Those earning less than 27850 will pay slightly less income tax in 2022-23 than if they lived elsewhere in the UK while those earning above that figure will pay slightly more. However for small taxpayers the late filing fee is of Rs 1000 if the taxable income does not exceed Rs 5 lakh. If you hold shares outside of a stocks and shares Isa youll have to pay tax on the dividends you earn if they exceed your dividend allowance 2000 in 2022-23.

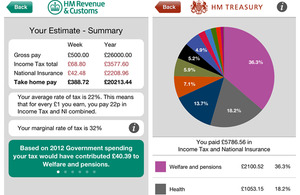

Estimate how much Income Tax and National Insurance you can expect to pay for the current tax year 6 April 2022 to 5 April 2023. Use the service to. Our suites of tax calculators are built around specific country tax laws and updated annually to provide a dependable tax calculator for your comparison of salaries when looking at new jobs reviewing annual pay.

Income up to 11850 - 0 income tax. In fact youd need to cash in a pension worth 415000 to buy a 288000 supercar paying enough tax to buy the Treasury a Porsche 126000. Income above 150001 - 45 income tax.

Find out how much income tax youll pay in. Note that your personal allowance will reduce by 1 for every 2 you earn over 100000. If you specified an annual gross salary the amount entered in the.

HM Revenue and Customs HMRC. Your financial situation. Tax credits calculator - GOVUK.

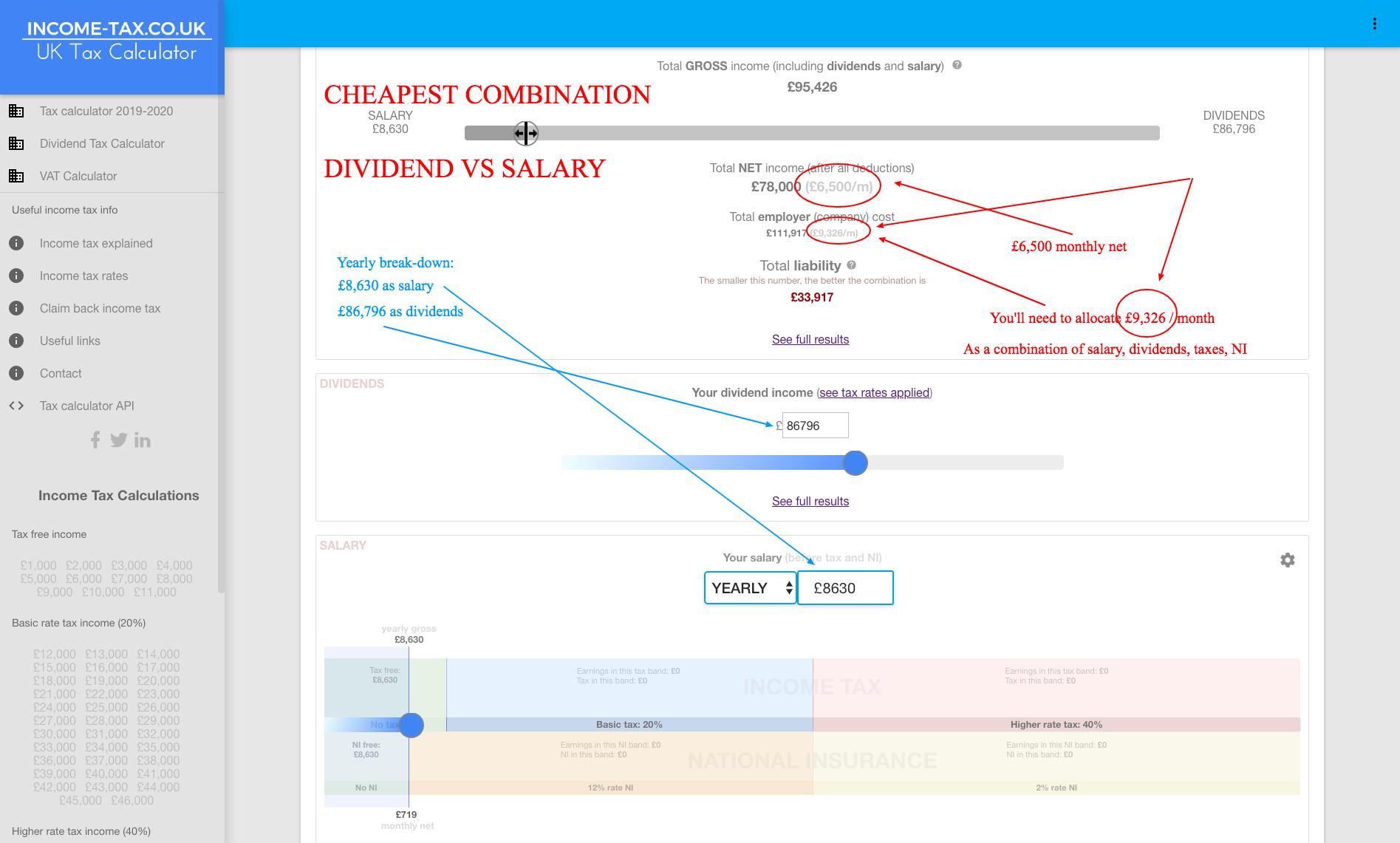

Income between 50271 and 150000 - 40 income tax. HMRCs tax calculator can help you check if youre being incorrectly taxed. Dividend tax calculator.

Government Monday said it wont proceed with the removal of a 45 top rate of income tax removing a key element of the mini-budget unveiled late last month that triggered turmoil in the. The results that the calculator give you are calculated with consideration to the most recent income tax and social security information available for the tax year 202223. See if your tax code has changed.

The Tax Calculators on iCalculator are updated for the 202223 tax year. Income Tax is a tax you pay on your earnings - find out about what it is how you pay and how to check youre paying the right amount using HMRCs tax calculator. The basic rate of 20 percent applies to annual earnings between 12571 and 50270.

Income between 12571 and 50270 - 20 income tax. The rates and bands are as follows. Free Online Salary and Tax Calculators designed specifically to provide Income Tax and Salary deductions for Individuals families and businesses.

For taxpayers who use married filing separate status the. Dividends are paid to investors who own shares in a company - they are a distribution of the profits a company has made. Use our income tax calculator for 2022-23.

20222023 Federal and State Income Tax Salary Calculator. You can find out everything you need to know about it in our guide. National Insurance calculator Income tax calculator Council tax calculator.

PensionIf you currently have a pension enter the amount that you pay into the pension on a regular basisThis can be entered in a percentage format eg. In 2022-23 the higher-rate tax threshold in most of the UK kicks in at 50270 the same as in 2021-22. As per the current income tax laws a late filing fee of up to Rs 5000 is levied if a belated ITR is filed.

Get free advice on how to deal with your debt online from the UKs leading debt charity. Of course many people dont do this - as it would land you with a huge tax bill. You can calculate your take home pay based of your gross income PAYE NI and tax for 202223.

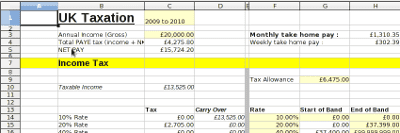

Note that for UK income above 100000 the Personal Allowance reduces by 1 for every 2 of income above the 100000 limit. Our self-employed and sole trader income. Income up to 12570 - 0 income tax.

Registered charity number. Do the sums Further information. Unique self-employed income calculator to help work out what you need to pay towards your income tax National Insurance take home pay.

This is your personal tax-free allowance. Use the simple tax calculator or switch to the advanced tax calculator to review employers national insurance payments income tax deductions and PAYE tax commitments for 2022. Income tax rates for 201819.

Its important to check youre paying the right amount of Income Tax. All income up to 12570 is tax-free this is the personal allowance.

Uk Tax Spreadsheets Paulbanks Org

Listentotaxman Uk Paye Salary Tax Calculator 2022 2023

Tax Returns Calculating Your Self Employment Tax Xero Uk

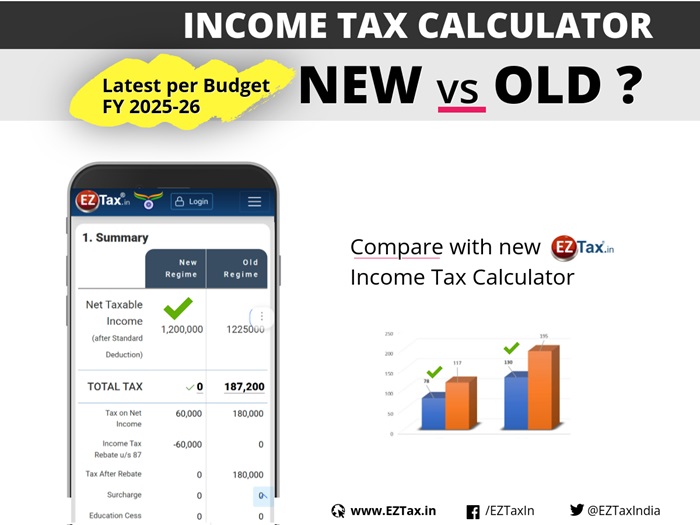

Income Tax Calculator For Fy 2022 23 Old Vs New Eztax

Salary Calculator Your Take Home Pay Blue Arrow

Self Employed Income Tax Calculator Clear House Accountants

Self Assessment Income Tax Calculator And Dates Accotax

Income Tax Calculator Five Quick Ways To Reduce Your Bill In 2022

![]()

Salary And Tax Deductions Calculator The Accountancy Partnership

Scottish Rate Of Income Tax Calculator Parliamentary Business Scottish Parliament

Income Tax Calculator Residents Expats And Pensioners 2022 Spanish Tax Calculator For Expats Pensioners Property Rentals

How Do I Work Out My Tax Low Incomes Tax Reform Group

Income Tax Uk Incometaxuk Twitter

Income Tax Co Uk Uk Tax Calculator Facebook

Self Assessment Calculator And Deadlines Money Donut

Tax Calculators Uk Tax Calculators

Income Tax Calculator 2020 21 Calculate Taxes For Fy 2020 21 Income Tax Slabs 2020 21